November 2024 Newsletter

Market Minute

Election Year Impact on Multifamily Real Estate

A recent JP Morgan article debunked the common myth in Multifamily Real Estate that election years cause irregular movement in the market: “‘Generally, individual elections have a limited impact on multifamily housing and the markets. “History tells us markets can get volatile around elections, but it’s usually temporary and related to the uncertainty,” said Ginger Chambless, Head of Research for Commercial Banking at JPMorgan Chase. “After the results, the direction of markets is more likely to be driven by the economic outlook and prevailing investor sentiment, rather than the election outcome itself—markets could rally simply because the election is behind us.”’

Similarly, a recent article from CBRE’s research team studied cap rates during election years and found: “…investment activity during the quarter when a presidential election was held and the following two quarters. There was no statistical evidence to suggest that the lifting of pre-election uncertainty unlocked capital. This gives us confidence that elections don’t impact investment activity over the short term. The same conclusion holds for property values: Rather than elections, broader macro conditions —particularly interest rates—are what drive changes in capitalization rates.”

‘Nxt Level’

Maintenance Appreciation Week

Risk management and asset preservation starts and ends with maintenance staff that think like owners of multifamily real estate. Our teams are trained to place a heavy emphasis on preventative maintenance and ensuring the properties they work at are well taken care of and hold value for decades to come.

In a show of our gratitude we recently held a Maintenance Appreciation Week. The week included catered breakfast, gift bags and culminated with an axe throwing event. We are thankful for the hard work all our maintenance team members demonstrate each and every day. They are the embodiment of Nxt’s culture and always strive to serve others like family.

Ask the Editor

Question: What marketing lead sources have yielded the best conversions?

Answer: Great question! We have seen an uptick in conversions that originate from Pay Per Click (PPC) campaigns. Rent Cafe conducted a national study where they surveyed over 1,500 properties and found that PPC campaigns average a 15.44% lead-to-lease conversion rate. The properties in our portfolio that most use PPC campaigns average a slightly higher conversion rate than that with one of our top properties bolstering an over 31% conversion rate from lead to lease.

As a reminder, feel free to ask any questions about the apartment world to sales@nxtmgt.com and we would love to feature and answer the question in next month’s newsletter.

Until next time,

October 2024 Newsletter

Market Minute

Top In-Demand Amenities

As owners and developers continue to look for the “best bang for [their] buck”, we are often asked which amenities are truly the most in-demand and which are most utilized. We recently conducted a survey of our property managers and asked them to rank amenities from most to least in-demand. They based their decisions according to the utilization they were seeing at their properties as well as resident and prospect feedback.

The following highlights some of our findings:

By overwhelming majority, pool/hot tubs were most in-demand. 63% of managers surveyed had it as the most solicited amenity. Pool/hot tub made up 47% of total 1st or 2nd place slots.

This was followed by fitness centers as the next most utilized or sought after amenity. 16% of those surveyed had it as the top amenity and 47% had it in the #2 slot.

Dog park/Pet areas, Clubhouse and BBQ areas then followed with fairly even distributions.

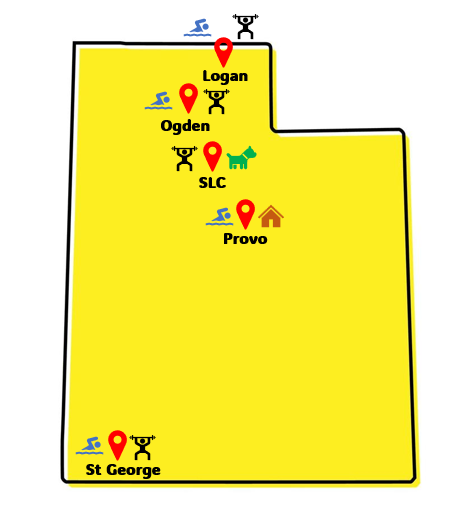

Broken down by the state’s major markets we see that:

Pools/hot tubs or fitness centers make up one or both of the top 2 amenities in each major market.

We observe some unique cases where pet areas and clubhouses account for the 2nd most in-demand amenity in the greater Salt Lake market and the Provo major market, respectively.

In Idaho Falls we still see Pool/hot tub as the most in-demand amenity overall, but with playground a close second.

We also polled our managers on any additional amenities that weren't listed in the ranking above:

The desire for a community garden appears in multiple different markets.

We observed that game rooms are also in-demand; with one manager mentioning that: “We have a game room with gaming consoles that gets used 3-4 times a week.”

The word cloud below outlines a few of the additional amenities that were mentioned from the managers:

‘Nxt Level’

Our New Business Intelligence Tool

We are pleased to announce the rollout of our new and improved business intelligence tool. Six years ago, Nxt was a trailblazer in the multifamily management industry with the rollout of the first iteration of its business intelligence tool (Nxt Dashboard). We have spent months gathering feedback and building this tool to assist our partners and the site teams in driving success at the properties we manage.

As a company, we pride ourselves on being able to use quality data to make data-driven decisions. The Nxt Dashboard has become a daily tool for our employees and has fostered success, new strategies, and transparency for everyone involved. Every community owner under Nxt’s management gets full access to this business intelligence dashboard. If you would like to see a demo, click the button below to schedule a demo. We would love to show you what it can do!

Ask the Editor

Question: What is your outlook on the market in general for the next 12-18 months? What trends are you seeing?

Answer: Great question! I’d like to share some statistics from the Gardner Institute which will help answer that:

From 2013 to 2023 Utah ranks 11th in the country in numeric employment increase and 1st in percent increase at 34.5%.

Utah has had over 2% employment growth year over year, higher than the 1.5% national average.

From 2012 to 2022 Utah ranks 12th in the country in numeric population increase and 1st in percent increase at 21.8%.

So far in 2024, there have been 622 building permits for apartments in Salt Lake City and the surrounding suburban areas. This is down significantly from 3,122 in 2023.

In summary, Utah continues to be one of the fastest growing states in the country with in-migration coming primarily from Nevada, Arizona and California. The decrease in permits submitted and issued year over year should allow vacant units and upcoming deliveries across the state to be absorbed. Noticeable changes to market conditions including rents, concessions and vacancies to be seen by Q3/Q4 2025—with decreased concessions already being seen in some markets in the state.

As a reminder, feel free to ask any questions about the apartment world to sales@nxtmgt.com and we would love to feature and answer the question in next month’s newsletter.

Until next time,

September 2024 Newsletter

Market Minute

Utah Major Market Growth

The below from CoStar depicts the five major Utah submarkets over the last two decades and their growth in various aspects. As you observe the graph you will note:

The x-axis (left to right) represents average market rent per unit. As time has transpired, average market per unit as uniformly increased.

The y-axis (up and down) represents average occupancy per market. Historically this has been between 90-95% with the exception of the last 2 years. Increased inventory has led to sub 90% average occupancy, but this is projected to improve as soon as next year.

The size of the circles (radius) represents the the comparable size in inventory (number of units), how each market compares to another in size and how individual markets have grown over time.

The legend below designates which colored circle belongs to each major market.

‘Nxt Level’

Sharpening Sales Skills

“Tell me and I forget, teach me and I may remember, involve me and I learn.” Benjamin Franklin, Founding Father of the United States

In today’s hyper-competitive multifamily market, the skill and expertise of on-site staff can make or break a property. This is especially paramount for new properties as they strive to achieve stabilization.

Recently, we hosted members of our on-site teams for an all day leasing and sales training. At Nxt, our goal is to continue to train and develop our team members so that they can perform to the best of their abilities and excel in comparison to their peers.

The training agenda led by our regional managers and operations staff covered topics such as understanding your target audience, nurturing leads into tenants, as well as other soft and hard sales skills. We finished the day with a fun activity where we had our teams build a fictitious property with various features and amenities. We then had them give us a tour tailored to our needs, as seen in the picture.

Ask the Editor

Question: What information can you provide regarding delivered and absorbed units across the state?

Answer: Great question! According to CoStar, the 5 major markets in Utah had the following in Q2 2024:

Logan: 49 absorbed units, 0 delivered units.

Ogden: 858 absorbed units, 470 delivered units.

Provo: 317 absorbed units, 308 delivered units.

Salt Lake: 1422 absorbed units, 1812 delivered units.

St George: 175 absorbed units, 5 delivered units.

The following is projected cumulatively for Q3 and Q4 2024:

Logan: 92 absorbed units, 0 delivered units.

Ogden: 645 absorbed units, 108 delivered units.

Provo: 924 absorbed units, 669 delivered units.

Salt Lake: 2336 absorbed units, 2297 delivered units.

St George: 178 absorbed units, 175 delivered units.

As a reminder, feel free to ask any questions about the apartment world to sales@nxtmgt.com and we would love to feature and answer the question in next month’s newsletter.

Until next time,

July 2024 Newsletter

Market Minute

According to a recent CoStar article, “Apartment rents in Salt Lake City increased by 0.6% month over month, the market’s fourth consecutive month of positive monthly rent growth. The last time the Utah Capital registered four months of monthly rent gains was in 2022.”

Additionally, “In recent months, renters have demonstrated a preference for multiple bedrooms. Rents in three-bedroom units increased by 1.3% quarter over quarter, while two-bedroom rates rose by 0.9%. One-bedroom rents grew by less than 0.1%, and studio rents were virtually flat.”

Over the last several quarters, Salt Lake City has led the state in units delivered which resulted in compressed rents and inflated concessions. The positive rent growth in arguably the most competitive market in the state inspires optimism for the near future not just in Salt Lake but also in adjacent cities.

‘Nxt Level’

It is no surprise that we have entered a new digital age where the average consumer, or prospective tenant in our industry, uses new tools when making decisions such as where to move to. These tools include social media, property websites, and online review platforms—with Google being the most popular.

A recent survey of 8,153 U.S. consumers found that nine in 10 consumers say they consider reviews when making a purchase decision. In today’s highly competitive multifamily market, the smallest factors such as average star review or a particularly good or bad review can make the difference between a new move-in and a lost lead.

This month, we would like to highlight how our on-site teams have embodied our mission statement to serve others like family by sharing some reviews we have gotten recently:

George (5 stars): “Went in for a tour and Briana was absolutely amazing and so helpful! I can’t wait to live here and be around such amazing people!”

Logan (5 stars): “If you want the kindest office staff, amazing location, and great townhomes this is the place to look. We were supposed to move out a couple of months ago and have decided to renew because our experience has been so good. We have felt at home here, it is so much better than any other apartment complex I have seen.”

Cherryrose (5 stars): “The property manager, Angie, is a phenomenal manager that will go above and beyond for her tenants. I think that’s what stands this property apart from the others. While others will just turn their heads and won’t bother to help. Angie really takes time to get to know her tenants and help them. Thank you Angie! I am so grateful for you.”

Ask the Editor

Question: Why should someone hire a management company instead of self-manage?

Answer: This is a great question! In our experience, there are often many things that go overlooked when an ownership group decides to try and self-manage a multifamily asset. As a professional management company, management is all we do! This allows us to help the asset perform to the maximum compared to an investing group that may try to vertically integrate to manage it.

Often, groups decide to take management “in-house” in an attempt to save money. What many have found is that the amount saved on the management fee pales in comparison to the efficiencies found when using 3rd party property management, as outlined below:

Marketing: we have a dedicated marketing team that are experts in social media and pay per click ads in an increasingly digital world.

Operational Efficiencies: our extensive portfolio allows us to leverage relationships to get discounted rates on services like landscaping, bulk internet and more. We also have the benefit to share staff between properties which lowers the payroll burden. This is especially important on smaller properties.

Other Income: we have noticed that in-house management companies leave a lot on the table as it pertains to other income items like pet rent, paid parking, amenity package income and more. These are usually not enforced as they should or they are not priced at market rate.

Staff: our sites have dedicated staff which boosts resident satisfaction and ensures the asset is taken care of.

Rent and Retention: our on-site staff are trained to excel in their individual markets to maximize lease and retention rates. They also perform a bi-weekly market analysis to ensure rents are priced at market to capture the highest income possible.

Accounting: our dedicated and experienced accounting team helps ensure everything is recorded and allocated accurately. Accounting is a common deficiency we have seen with groups who self-manage.

Want to be the first to know about what’s happening “Nxt”? Sign up for our newsletter email below!

Until next time,

May 2024 Newsletter

Market Minute

According to ABC4, “In the last year, those moving to Utah accounted for 56% of the Beehive State’s population increase.” Continued population growth combined with a decrease in units under construction over the next several quarters, leads experts to believe that vacancy will begin to trend downward after a period of historic highs.

The graph below from Costar displays the five major markets in Utah, their trending average vacancy over the last 4 quarters and also a forecasted average vacancy for the next 5 quarters.

We observe that almost every major market is forecasted to have a significant drop in average vacancy with top 3 markets dropping from 14-16% vacancy to about 10%.

Lastly, the ABC4 article also noted: “Over the last year, Utah County accounted for 39% of the state’s population increase. That’s followed by Salt Lake County, at 25%.

‘I think what we’ve been seeing is that as Salt Lake County has become more and more expensive, you’ve been seeing more people migrate into what we call the ring counties or even Utah County’”.

‘Nxt Level’

It's no secret that we have entered a difficult and competitive time in multifamily real estate. With that being said, we are pleased to announce that we have achieved the milestone of being 100% leased, and 97% occupied at one of our larger properties that was in lease-up! According to Costar, “Vacancy in [that market] has soared to 14.9%, more than double its historical average of 7.0%.” Despite that, we have still managed to have success in the area.

Additionally, in another market, we also hit the milestone of being 99% occupied and 100% leased on another property we manage at 100 units! We recently took-over this project at less than 80% occupancy and within two months, reached stabilization.

Our team has worked hard to serve others like family, diligently follow-up with leads, and provide a high quality resident experience. The combination of those things and more has allowed us to succeed in a competitive multifamily market.

Ask the Editor

Question: What unit types are most in-demand by tenants?

Answer: This is a great question! It definitely varies by market but I would say that as a general trend we have observed that tenants are gravitating towards smaller units, 1 and 2 beds as opposed to larger units like 3 or 4 beds.

For example, we recently toured new projects in Logan, UT and the feedback we got from the property managers at those sites was that their 1 bedroom units and units situated in the middle floors (i.e. floors 2 and 3 of a 4 floor building) leased more quickly. This leads us to believe that tenants are more price-conscious in today’s market and as families trend towards being smaller, the need for larger units is not as common as it once was. This was surprising to discover especially in the Logan, UT market where most projects had been tailored towards larger families previously.

As a reminder, feel free to ask any questions about the apartment world to sales@nxtmgt.com and we would love to feature and answer the question in next month’s newsletter.

Until next time,

April 2024 Newsletter

Welcome to our first monthly newsletter! This newsletter will contain three distinct sections: Market Minute, Nxt Level, and Ask the Editor. Join us as we update you on all things Nxt!

Welcome to our first monthly newsletter!

This newsletter will contain three distinct sections: Market Minute, Nxt Level and Ask the Editor. The first section is aimed to bring value to you as an investor in multifamily real estate by speaking to trends, statistics and more in the market. The second section will be utilized to demonstrate our expertise in property management and to highlight our biggest wins. The last section will be reserved to answer your questions. That can be regarding market statistics, trends or anything you'd like us to research further.

Market Minute

With a whopping 4,047 units currently under construction, the downtown Salt Lake City submarket leads all other submarkets in the state, according to Costar. The influx of new development has spread to other areas of the state such as 772 units under construction in the North Utah County submarket and 289 units under construction in the Northern Davis County submarket.

With plentiful land for sale and a low multifamily presence, today we would like to highlight the Cache County Submarket as an area of opportunity for multifamily development. Per Costar, there are only 69 units under construction a fraction of the 284 units under construction in Northern Weber County, the nearest other submarket in the state.

Lastly, Costar estimates a population of 127,771 as of 2023 in a 10 mile radius centered in Logan. They project that will increase to 137,667 by 2028. That is an increase of 9,896 or 7.75%.

'Nxt' Level

Nxt Property Management is a premier third party manager of multifamily housing with over 5,800(+) units under management. We are a growing third-party management company which has a culture of interconnection that most companies want to emulate. Our exceptional leaders at Nxt have over 30 years of experience that has resulted in top level operational performance and a personal-touch culture at each property we oversee.

Nxt was established in 2017 under Western States Lodging & Management (WSLM), a company with over 30 years of expertise in real estate development, hospitality and senior care property management. Nxt draws significant advantages from WSLM's extensive experience and robust back-end systems, including HR and Accounting. Guided by the mission statement "Serving you like Family," Nxt is inspired to extend this ethos in interactions with our residents, clients, and associates.

Ask the Editor

Dear reader,

First and foremost thank you for having taken the time to read this newsletter we worked hard to put together for you. These are meant to be for YOU and your benefit.

This last section of each newsletter will be reserved to answer YOUR questions! You can email sales@nxtmgt.com to submit your question regarding market statistics, trends or anything you'd like us to research further. We will be answering at least one question each month from the prior newsletter's submissions.

Want to be the first to know about what’s happening “Nxt”? Sign up for our newsletter email below!

Until next time,

Making Your Rental Pet-Friendly: Tips and Tricks for Pet Owners

Renting a home with a furry companion can be a rewarding experience, but it also comes with its own set of challenges. From navigating pet policies to maintaining a harmonious living environment, there are several factors to consider when living in a rental with pets. Whether you're a seasoned pet owner or a first-time renter with a furry friend, these tips and tricks will help you make your rental home a pet-friendly haven.

Renting a home with a furry companion can be a rewarding experience, but it also comes with its own set of challenges. From navigating pet policies to maintaining a harmonious living environment, there are several factors to consider when living in a rental with pets. Whether you're a seasoned pet owner or a first-time renter with a furry friend, these tips and tricks will help you make your rental home a pet-friendly haven.

1. Understand Your Lease Agreement:

Before signing the lease, carefully review the pet-related clauses and restrictions. Pay attention to any breed or size limitations, pet deposits or fees, and rules regarding pet behavior and cleanliness. Understanding your lease agreement will help you avoid any misunderstandings or conflicts with your landlord later on.

2. Communicate with Your Management Team:

Open and honest communication with your leasing management team is key to maintaining a positive relationship. Inform them about your pet(s) upfront and discuss any concerns or questions they may have. Providing references from previous landlords or demonstrating your pet's good behavior can also help ease their concerns.

3. Establish a Pet Routine:

Create a consistent routine for your pet to minimize disruptions and promote a sense of stability. Set regular feeding times, exercise routines, and bathroom breaks to help your pet adjust to their new environment. A well-established routine can also prevent accidents and reduce anxiety in your pet.

4. Pet-Proof Your Home:

Take proactive measures to pet-proof your rental home and prevent damage or accidents. Secure loose wires, remove toxic plants, and invest in sturdy pet gates or barriers to restrict access to certain areas. Keep valuable or fragile items out of reach to minimize the risk of damage.

5. Invest in Pet-Friendly Furniture and Accessories:

Opt for pet-friendly furniture and accessories that are durable, easy to clean, and resistant to wear and tear. Choose stain-resistant fabrics, washable slipcovers, and scratch-resistant surfaces to protect your belongings from pet-related damage. Consider investing in a designated pet bed or scratching post to provide your pet with a comfortable and safe space of their own.

6. Regular Grooming and Maintenance:

Maintain your pet's grooming and hygiene to keep your rental home clean and odor-free. Regularly groom your pet, trim their nails, and bathe them as needed to minimize shedding and prevent unpleasant odors. Vacuum and clean your home regularly to remove pet hair and dander, and address any accidents promptly to prevent stains and odors from setting in.

7. Be a Considerate Neighbor:

Respect your neighbors by keeping noise levels to a minimum and addressing any barking or disruptive behavior promptly. Be mindful of shared spaces and clean up after your pet when using common areas such as hallways, elevators, or outdoor spaces. Consider introducing your pet to your neighbors to foster a sense of community and goodwill.

Living in a multifamily apartment or townhome with pets requires patience, responsibility, and a proactive approach to pet care. By following these tips and tricks, you can create a harmonious living environment for both you and your furry companion. Remember, a happy pet makes for a happy home!

Creative Ways to Decorate Your Rental Without the Damage

Decorating a rental unit can be a tricky task, especially when you want to personalize your space without risking your security deposit. However, with a bit of creativity and the right approach, you can transform your rental into a cozy and stylish sanctuary without causing any damage. In this post, we'll explore some ingenious ways to decorate your rental apartment while keeping it landlord-friendly.

Decorating your apartments can be a tricky task, especially when you want to personalize your space without risking your security deposit. However, with a bit of creativity and the right approach, you can transform your rental into a cozy and stylish sanctuary without causing any damage. In this post, we'll explore some ingenious ways to decorate your rental apartment while keeping it landlord-friendly.

Removable Wallpaper: Traditional wallpaper can be a nightmare to remove, but removable wallpaper offers a temporary solution that won't damage your walls. With a myriad of designs and patterns available, you can easily add personality and charm to your space. Whether you prefer a bold accent wall or a subtle backdrop, removable wallpaper allows you to experiment with different styles without the fear of leaving behind a mess.

Command Hooks and Strips: Command hooks and adhesive strips are invaluable tools for renters seeking to hang artwork, mirrors, or shelves without drilling holes. These products utilize adhesive technology that sticks to various surfaces, such as painted walls and tiles, and can be removed without causing any damage. From organizing kitchen utensils to displaying your favorite photos, command hooks offer versatility and convenience.

Temporary Flooring Solutions: While you may not have the option to replace the flooring in your rental, you can still enhance it with temporary solutions. Rugs are an excellent way to add warmth and texture to a room while protecting the existing flooring underneath. Whether you prefer a plush area rug in the living room or a durable runner in the hallway, investing in quality rugs can instantly elevate the aesthetic of your space.

Decorative Window Treatments: Customizing your window treatments can dramatically enhance the ambiance of your space. Opt for tension rods and lightweight curtains or blinds that can be easily installed and removed without drilling holes. Sheer curtains can soften harsh sunlight, while blackout curtains provide privacy and block out unwanted light. Additionally, decorative window films offer a stylish alternative to traditional curtains, allowing you to customize your windows with various patterns and designs.

Furniture with Dual Functionality: Maximize the functionality of your home by investing in furniture that serves multiple purposes. Look for pieces such as storage ottomans, sleeper sofas, and nesting tables that offer versatility without taking up too much space. These multifunctional furniture items not only add aesthetic value to your home but also enhance its practicality and efficiency.

Artful Arrangements and Decor: When it comes to decorating your apartment, the key is to focus on decorative elements that can easily be removed or rearranged. Experiment with gallery walls using removable picture hanging strips, and incorporate decorative accents such as throw pillows, blankets, and wall decals to infuse personality into your space. By curating artful arrangements and decor, you can transform your rental apartment into a reflection of your unique style and taste.

Decorating your space without damaging the unit requires creativity, resourcefulness, and a willingness to think outside the box. By utilizing removable decor, temporary solutions, and multifunctional furniture, you can personalize your space while maintaining its integrity and ensuring a smooth transition when it's time to move out. With these tips and tricks, you can create a stylish and inviting home that reflects your personality and lifestyle, regardless of rental restrictions.